FX Global Trades Market Pro Forex market (short for “foreign exchange”) is the largest and the most liquid financial market where the global currencies are traded. Forex traders purchase currencies with the intent to make money off of the difference between the buying and the selling prices. Get in on the action of the most traded market in the world. The largest volume market in the world is currency exchange, with an average daily turnover of five trillion dollars. Traded across the global banking system, the spot forex market offers tremendous liquidity and opportunity. FX Global Trades Market Pro offers 10 of the most popular forex pairs as limited-risk binary options and spreads. You can trade them 24 hours a day, 5 days a week. The forex market has an average daily turnover of $5 trillion as traders strive to turn a profit by speculating on the value of one currency compared to another. Ready to be part of the market moves with a global leader in online currency trading?

Our Bitcoin Spreads let you trade the price of Bitcoin (based on the trusted TeraBit IndexSM) without having to own bitcoins. There's no need for wallets or conversion, since the contracts are settled in US dollars. Best of all, it's as easy to trade price drops as it is to trade rallies. Short-selling Bitcoin is as easy as buying when you use Bitcoin Spreads. As the price of Bitcoin varies up and down, the spread's value moves as well, but with limits. Above the ceiling or below the floor, the value of the spread stops moving and remains at its upper or lower limit (depending on whether you are a buyer or seller). In this way, your risk-reward remains within a defined range. One limit is your profit target. The other is your guaranteed protection against unlimited losses.

Since its "hacker" beginnings, Bitcoin and cryptocurrency have gone mainstream and soared in value. More traders than ever want to add cryptocurrencies to their portfolios. However, the volatility makes the Bitcoin market good for short-term trades, not just "buy and hold." Our Bitcoin Spreads allow you to take short-term positions on the price of Bitcoin, with risk-reward protections built in. Selling is as easy as buying, meaning you have profit opportunities no matter which direction the Bitcoin market is trending. Trade the price of Bitcoin without buying and selling the bitcoins themselves. No "mining," no risk exposure outside your comfort level—you can just trade with all the benefits of our platform: limited risk, transparent price, and CFTC regulation.

Commodities are basic to our daily life, which makes the commodity futures markets among the largest, with huge trading volumes. Binary options and spreads give you a different way to trade commodities—with limited risk and a lower cost of entry. You can never be stopped out or get a margin call.

We offer binaries on these metals, energies and agricultural products:

Metal: gold, silver, copper

Energy: crude oil and natural gas

Agricultural: corn and soybeans

In 2014, the price of crude oil fell by more than half. Oil-dependent economies like Russia’s suffered, while consumers enjoyed lower gas prices. Volatility was widespread. Most traders are not prepared or lack the capital to trade commodity futures alongside the big players, especially when things are volatile. With our binary options and spreads, you trade commodity futures prices with smaller risk. You set your maximum possible loss before you enter the trade. If the market spikes against your position, your loss is limited and you won’t get stopped out even if your binary's value goes to zero. With our binary options and spreads, you can exit the trade prior to expiration, to take profits or avoid taking the maximum loss.

Most successful traders start off small, with the goal of learning and improving. However, in the world of commodity futures, small accounts face a lot of challenges. Most commodity trading educators assume you have $25,000 or more to start with, so that you can handle drawdowns of several thousand dollars and still come out on top. While that works for some, many traders want a different risk/reward profile, even if they have ample funds. That’s why we require a low initial deposit to fund your account (though most of our members do start with more). That’s also why we don’t promise “unlimited profit potential.” We have found that most traders are comfortable with capped profit in exchange for limited risk.

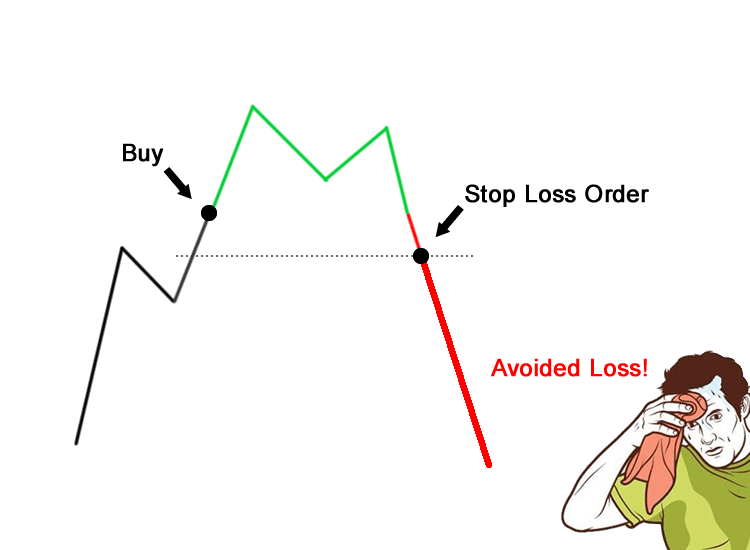

Commodity traders traditionally use stop-loss orders to limit risk. However, even with a stop, you still have the risk of slippage. You may incur a greater loss than you were prepared for or even get a margin call. With binary options and spreads, your maximum risk is set before you enter the trade. No unpleasant surprises if a trade doesn’t go your way. In fact, we doesn’t issue margin calls. Our binary options and spreads give you staying power in fast-moving, volatile markets. Most traders know the frustration of having the market move against you, getting stopped out, and watching it move back into profit territory. With us, you don't get stopped out, ever. If and when the market comes back, you're still in the trade. You can exit when you decide or hold to expiration.

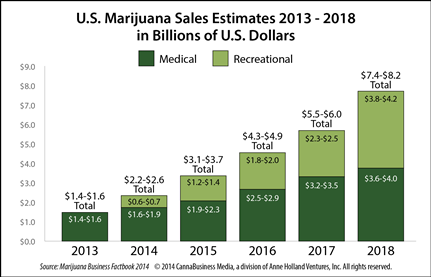

Marijuana s the world's most commonly cultivated, trafficked, and used illicit drug, and as the push for legalization at home and abroad grows, marijuana is garnering significant attention from investors, manufacturers, and researchers. Despite the plant being illegal under federal law as a Schedule I drug, the U.S. legal marijuana industry was estimated at $10.4 billion in 2018 with 250,000 jobs devoted to the handling of plants, according to New Frontier Data. A total of 33 states have legalized marijuana for medical use, 10 of which allow adults to legally use the drug for recreational use. And that number may continue to rise, as more people are accepting the idea of legalizing marijuana across the United States. This article looks at some of the uses of marijuana as well as the overall market for the drug.

Crude Oil is a trading instrument that offers a guaranteed return for a correct prediction about an asset’s price direction within a selected timeframe. An in-the-money option offers up to 30% of profit every 30 days, while an unsuccessful one will result in the loss of the investment. With Crude Oil one can speculate on the price movements of various stocks, currency pairs, indices, commodities and even Cryptocurrencies.

Trust comes first. In accordance with our company's transparency policy, our customers have the right to receive any information they request at any time. Our team working for fair mining will publish all data openly that will not jeopardize our competitive advantage. Shown below from the company registration source of FX Global Trades Market Pro LTD.